Earnings, schmearnings. Is what really matters just liquidity?

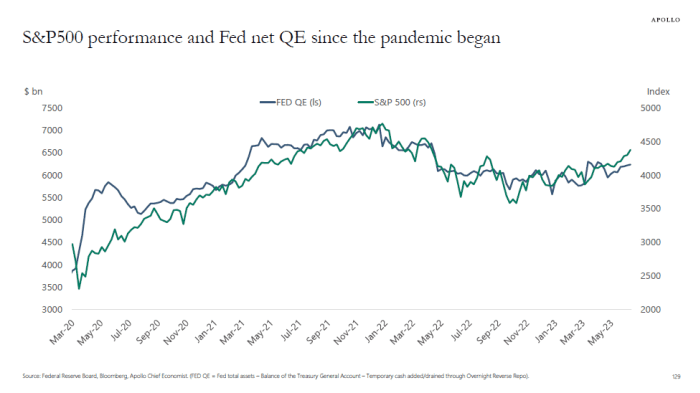

This incredible chart, from Apollo Global Management chief economist Torsten Slok, shows the close relationship between S&P 500 SPX, performance and net Federal Reserve quantitative easing (QE) since the pandemic began.

Here, Fed QE is defined as the Fed’s total assets minus the balance of the Treasury General Account as well as the temporary cash added or drained through overnight reverse repos.

“Since SVB collapsed, the Fed has been adding liquidity, and the S&P 500 is up more than 10%. The high correlation between Fed net QE and the S&P 500 seen in the chart below suggests that Fed liquidity is a crucial driver of the stock market,” said Slok.

The Fed would dispute that the emergency lending programs put in place are a form of quantitative easing, but nonetheless, its balance sheet has expanded.

Slok also warned, however, that what the Fed gives, the Fed can take away.

“With the Fed turning more hawkish and continuing QT [quantitative tightening], the downside risks to equities are growing,” he said.

It should, of course, be noted that dual Y charts are inherently misleading, since the magnitude can be altered just by playing with the axes. That said, the idea that liquidity is a key driver of financial asset performance is widely shared. One of the concerns coming out of the debt-ceiling impasse was the impact of delayed Treasury bill issuance.

“Since March, money market funds have seen a half trillion-dollar inflow due to bank depositors seeking safety,” says John Lynch, chief investment officer for Comerica Wealth Management.

“To the extent that T-bills offer a yield advantage over reverse repos (overnight loans of T-bills made by the Fed), money market funds will have an incentive to buy T-bills, thereby filling the Treasury’s coffers. The Treasury Department’s goal is that this funding will prove ‘liquidity neutral.’ Thus far in the process, reverse repos have been working. However, if money market funds begin to favor other short-term instruments like CDs and commercial paper, pricing will come under pressure and Treasury will need to rely on bank reserves, further draining liquidity in the months ahead.”

U.S. markets are closed Monday in observance of the Juneteenth holiday. The S&P 500 has gained 15% this year, and the tech-heavy Nasdaq 100 NDX, has surged 38%.

"close" - Google News

June 19, 2023 at 03:47PM

https://ift.tt/ic9s2U7

This incredible chart shows the close relationship between the S&P 500 and Fed liquidity - MarketWatch

"close" - Google News

https://ift.tt/dGIX7Qq

https://ift.tt/vUMLioJ

Bagikan Berita Ini

0 Response to "This incredible chart shows the close relationship between the S&P 500 and Fed liquidity - MarketWatch"

Post a Comment